Page 18 - Demo

P. 18

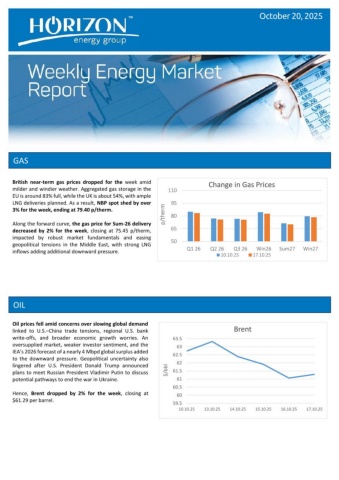

GAS OIL Oil prices fell amid concerns over slowing global demand linked to U.S. China trade tensions, regional U.S. bank –write-offs, and broader economic growth worries. An oversupplied market, weaker investor sentiment, and the IEA’s 2026 forecast of a nearly 4 Mbpd global surplus added to the downward pressure. Geopolitical uncertainty also lingered after U.S. President Donald Trump announced plans to meet Russian President Vladimir Putin to discuss potential pathways to end the war in Ukraine. Hence, Brent dropped by 2% for the week, closing at $61.29 per barrel. October 20, 2025 50658095110Q1 26Q2 26Q3 26Win26Sum27Win27p/thermChange in Gas Prices10.10.2517.10.2559.56060.56161.56262.56363.510.10.2513.10.2514.10.2515.10.2516.10.2517.10.25$/bblBrent British near-term gas prices dropped for the week amid milder and windier weather. Aggregated gas storage in the EU is around 83% full, while the UK is about 54%, with ample LNG deliveries planned. As a result, NBP spot shed by over 3% for the week, ending at 79.40 p/therm. Along the forward curve, the gas price for Sum-26 delivery decreased by 2% for the week, closing at 75.45 p/therm, impacted by robust market fundamentals and easing geopolitical tensions in the Middle East, with strong LNG inflows adding additional downward pressure.