Page 16 - Demo

P. 16

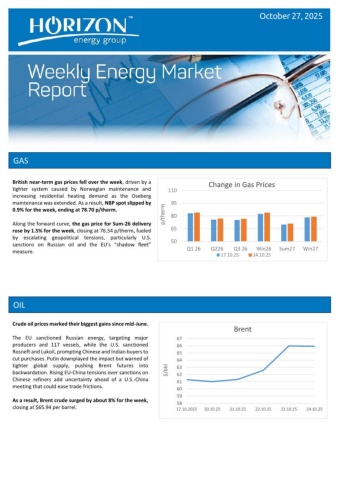

GAS OIL Crude oil prices marked their biggest gains since mid-June. The EU sanctioned Russian energy, targeting major producers and 117 vessels, while the U.S. sanctioned Rosneft and Lukoil, prompting Chinese and Indian buyers to cut purchases. Putin downplayed the impact but warned of tighter global supply, pushing Brent futures into backwardation. Rising EU-China tensions over sanctions on Chinese refiners add uncertainty ahead of a U.S.-China meeting that could ease trade frictions. As a result, Brent crude surged by about 8% for the week, closing at $65.94 per barrel. October 27, 2025 50658095110Q1 26Q226Q3 26Win26Sum27Win27p/thermChange in Gas Prices17.10.2524.10.255859606162636465666717.10.202520.10.2521.10.2522.10.2523.10.2524.10.25$/bblBrent British near-term gas prices fell over the week, driven by a tighter system caused by Norwegian maintenance and increasing residential heating demand as the Oseberg maintenance was extended. As a result, NBP spot slipped by 0.9% for the week, ending at 78.70 p/therm. Along the forward curve, the gas price for Sum-26 delivery rose by 1.5% for the week, closing at 76.54 p/therm, fueled by escalating geopolitical tensions, particularly U.S. sanctions on Russian oil and the EU’s “shadow fleet” measure.