Page 14 - Demo

P. 14

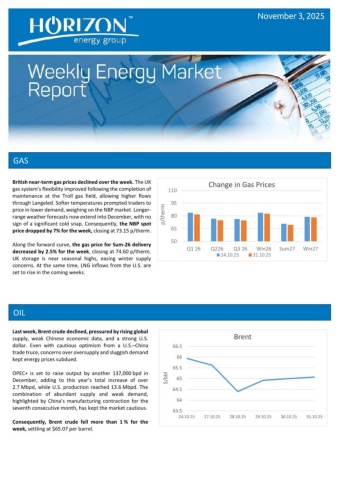

GAS OIL Last week, Brent crude declined, pressured by rising global supply, weak Chinese economic data, and a strong U.S. dollar. Even with cautious optimism from a U.S. China –trade truce, concerns over oversupply and sluggish demand kept energy prices subdued. OPEC+ is set to raise output by another 137,000 bpd in December, adding to this year’s total increase of over 2.7 Mbpd, while U.S. production reached 13.6 Mbpd. The combination of abundant supply and weak demand, highlighted by China’s manufacturing contraction for the seventh consecutive month, has kept the market cautious. Consequently, Brent crude fell more than 1 % for the week, settling at $65.07 per barrel. November 3, 2025 50658095110Q1 26Q226Q3 26Win26Sum27Win27p/thermChange in Gas Prices24.10.2531.10.2563.56464.56565.56666.524.10.2527.10.2528.10.2529.10.2530.10.2531.10.25$/bblBrent British near-term gas prices declined over the week. The UK gas system’s flexibility improved following the completion of maintenance at the Troll gas field, allowing higher flows through Langeled. Softer temperatures prompted traders to price in lower demand, weighing on the NBP market. Longer-range weather forecasts now extend into December, with no sign of a significant cold snap. Consequently, the NBP spot price dropped by 7% for the week, closing at 73.15 p/therm. Along the forward curve, the gas price for Sum-26 delivery decreased by 2.5% for the week , closing at 74.60 p/therm. UK storage is near seasonal highs, easing winter supply concerns. At the same time, LNG inflows from the U.S. are set to rise in the coming weeks.