Page 20 - Demo

P. 20

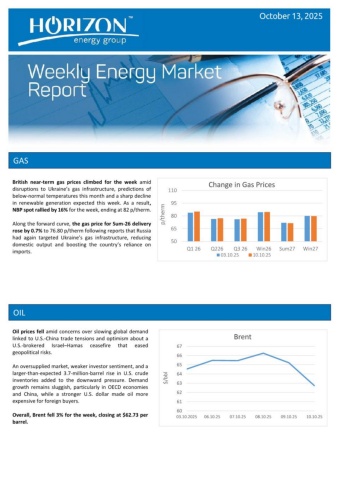

GAS OIL Oil prices fell amid concerns over slowing global demand linked to U.S.-China trade tensions and optimism about a U.S.-brokered Israel Hamas –ceasefire that eased geopolitical risks. An oversupplied market, weaker investor sentiment, and a larger-than-expected 3.7-million-barrel rise in U.S. crude inventories added to the downward pressure. Demand growth remains sluggish, particularly in OECD economies and China, while a stronger U.S. dollar made oil more expensive for foreign buyers. Overall, Brent fell 3% for the week, closing at $62.73 per barrel. October 13, 2025 50658095110Q1 26Q226Q3 26Win26Sum27Win27p/thermChange in Gas Prices03.10.2510.10.25606162636465666703.10.202506.10.2507.10.2508.10.2509.10.2510.10.25$/bblBrent British near-term gas prices climbed for the week amid disruptions to Ukraine’s gas infrastructure, predictions of below-normal temperatures this month and a sharp decline in renewable generation expected this week. As a result, NBP spot rallied by 16% for the week, ending at 82 p/therm. Along the forward curve, the gas price for Sum-26 delivery rose by 0.7% to 76.80 p/therm following reports that Russia had again targeted Ukraine’s gas infrastructure, reducing domestic output and boosting the country’s reliance on imports.