Page 2 - Demo

P. 2

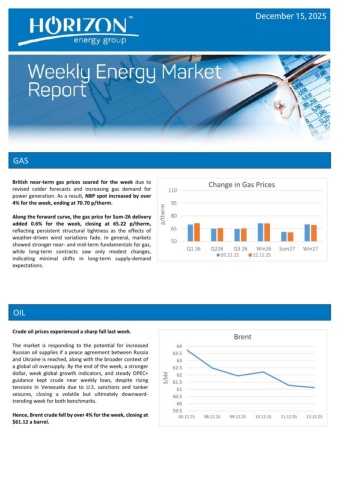

GAS OIL Crude oil prices experienced a sharp fall last week. The market is responding to the potential for increased Russian oil supplies if a peace agreement between Russia and Ukraine is reached, along with the broader context of a global oil oversupply. By the end of the week, a stronger dollar, weak global growth indicators, and steady OPEC+ guidance kept crude near weekly lows, despite rising tensions in Venezuela due to U.S. sanctions and tanker seizures, closing a volatile but ultimately downward- trending week for both benchmarks. Hence, Brent crude fell by over 4% for the week, closing at $61.12 a barrel. December 15, 2025 50658095110Q1 26Q226Q3 26Win26Sum27Win27p/thermChange in Gas Prices05.12.2512.12.2559.56060.56161.56262.56363.56405.12.2508.12.2509.12.2510.12.2511.12.2512.12.25$/bblBrent British near-term gas prices soared for the week due to revised colder forecasts and increasing gas demand for power generation. As a result, NBP spot increased by over 4% for the week, ending at 70.70 p/therm. Along the forward curve, the gas price for Sum-26 delivery added 0.6% for the week, closing at 65.22 p/therm, reflecting persistent structural tightness as the effects of weather-driven wind variations fade. In general, markets showed stronger near- and mid-term fundamentals for gas, while long-term contracts saw only modest changes, indicating minimal shifts in long-term supply-demand expectations.